With the Biden Administration announcing new guidelines for AI safety – including requiring innovators to share critical information with the federal government – it is clear that cybersecurity stakeholders must also defend against the serious threat AI poses to online security, privacy, and data …

How Photolok is an Innovative & AI-Proof Passwordless IdP Solution

By Chuck Brooks Traditionally, strong passwords have been a first-tier defense against cyber-attacks and breaches. However, with the development of AI and ML tools, the effectiveness of cyber-defense has been thoroughly diminished, especially from more sophisticated cyber actors who use AI/ML …

[Read more...] about How Photolok is an Innovative & AI-Proof Passwordless IdP Solution

NSA and Partners Identify China State-Sponsored Cyber Actor Using Built-in Network Tools When Targeting U.S. Critical Infrastructure Sectors

Press Release | May 24, 2023 The National Security Agency (NSA) and partners have identified indicators of compromise (IOCs) associated with a People’s Republic of China (PRC) state-sponsored cyber actor using living off the land techniques to target networks across U.S. critical …

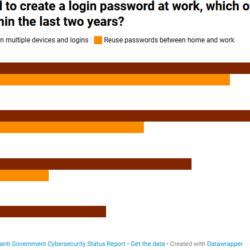

Report: Youth Won’t Save Government from Bad Cyber Hygiene

A new survey of government office workers across the world found that “digital natives” — those who grew up with modern technology — are actually more likely than older employees to exhibit bad password habits. Government Technology, March 09, 2023 • News Staff For those who grew up with …

[Read more...] about Report: Youth Won’t Save Government from Bad Cyber Hygiene

Is Cybercrime the World’s Third Largest Economy After the U.S. & China?

CyberheistNews Vol 13 #05 | January 31st, 2023 Cybersecurity Ventures released a new report that claims cybercrime is going to cost the world $8 trillion in 2023. If it were measured as a country, then cybercrime would be the world's third largest economy after the U.S. and China. The …

[Read more...] about Is Cybercrime the World’s Third Largest Economy After the U.S. & China?

Physicist’s Experience with Photolok

Source: Paul Sigismondi, Ph.D., is a research physicist and educator. He has a B.S. in Physics from the University of California at Berkeley and a Ph.D. in Physics from the University of North Carolina at Chapel Hill. His research interests include theoretical astrophysics and quantum field …